A New Generation of Tech-powered Regulated Lenders Disrupting the Lending Market

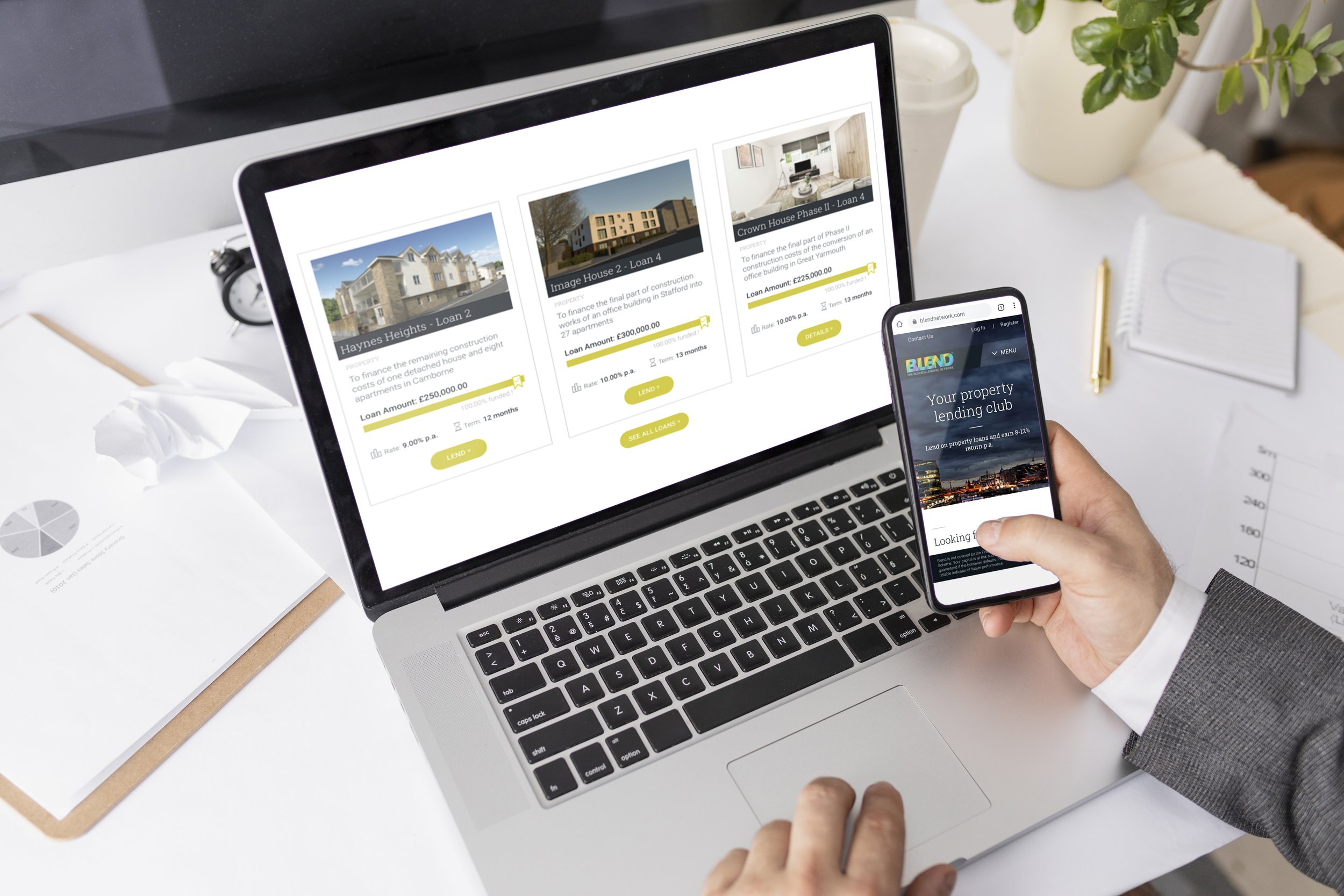

Paul Watson is the Head of Origination at Blend Network. Here, he discusses how specialist development finance lenders use technology to better help property developers.

We are often told to use the right tool for the job. Specialist finance requires specialist lenders, and so real estate development finance requires niche lenders who can get their head around the intricacies of building a ground-up development or doing a conversion. Paul Watson, Head of Origination at specialist lender Blend Network, explains how the new generation of specialist, tech-powered regulated lenders are helping property developers.

Whereas a few years ago we lived in a much more ‘generalist’ society where we used doctors, salespeople and lenders, nowadays we live in an increasingly ‘specialist’ world where we can access professionals with a high degree of expertise in niche fields such as orthotics, digital marketing and real estate development finance lending. This evolution is nowhere more relevant than in the financial lending industry. Only a few years ago, a generalist lending manager at a high street bank was tasked with assessing loan requests for all types of different purposes, from building or buying a house to purchasing a car or paying for a wedding. However, the emergence of so called ‘specialist lenders’ over the past decade has brought a breath of fresh air into the financial lending industry by allowing for a much more tailored service and customized lending solutions. Nowadays, the high degree of specialism in the financial lending industry means that in the same manner we wouldn’t go to a supermarket to buy a car, we wouldn’t go to a high street bank to request a development finance loan.

The truth is that building a ground-up block of flats, doing a commercial-to-residential conversion, or even renovating a house into HMOs involves having a lender who truly understands the property development process and can get their heads around how it works. Property development deals are rarely standardized one-size-fits-all deals. Most often, they will be non-standardized deals with quirky features that require unique structured solutions. For example, HMOs may offer very small capital appreciation to the borrower with rental income being the main reason for the investment. Or there may be planning uplift that needs to be taken into account when assessing a ground-up development deal. Traditional or ‘generalist’ lenders are usually happy to lend on off-the-shelf deals that are easy to value based on market comparables. Yet when it comes to nonstandard deals in nonstandard locations, specialist lenders are more likely to get comfortable with them, provided that the deals make sense. Another important factor is that specialist lenders are often staffed with experts with professional expertise in the specific area where the loan proceeds are to be used. For example, at Blend Network our development finance underwriters have years of property development experience under their belt, thus being able to speak the borrower’s language.

It is no surprise then that specialist finance providers have become the key go-to lenders for development finance. With their nimble setup, flexible structure, dynamic approach to lending, sharp use of technology and top-notch customer service, specialist development finance lenders are able to better serve time-poor property developers who have grown accustomed to faster, better and simpler processes with good old-fashioned customer service.

But there is one key area where this new generation of specialist lenders have really been able to add value: the gearing offered to property developers. In a market – property – where cash is always king and winning a deal may depend on the lender’s ability to move quickly, gearing is one of specialist lenders’ key selling points. Their more flexible setup compared to traditional lenders helps structure deals in a way that works for the borrower. For example, at Blend Network we have structures in place that allow us to go up to 73% Loan-To-Gross-Development-Value (LTGDV), thus effectively blending senior and mezzanine into one loan.

In summary, a new generation of tech-powered regulated lenders is disrupting the real estate development finance lending market, and it is easy to see why: they are faster, better, simpler.

Blend Network is a next generation specialist real estate development finance lender. The company, based in London, is an active lender all across the UK regions including England, Northern Ireland, Wales and Scotland. More information can be found at www.blendnetwork.com. Blend Loan Network Limited is authorised and regulated by the Financial Conduct Authority (Reg No: 913456)