The Importance of the Capital Stack

Michael Bristow is the CEO and Co-Founder of CrowdProperty. In this article, he talks about the capital stack and its significance.

Now two years on from the start of the pandemic, the UK is facing new uncertainties around the war in Ukraine impacting energy prices and the rate of inflation. With so many factors that have the potential to impact the market, CrowdProperty shares views on what this will mean for the sector going forward.

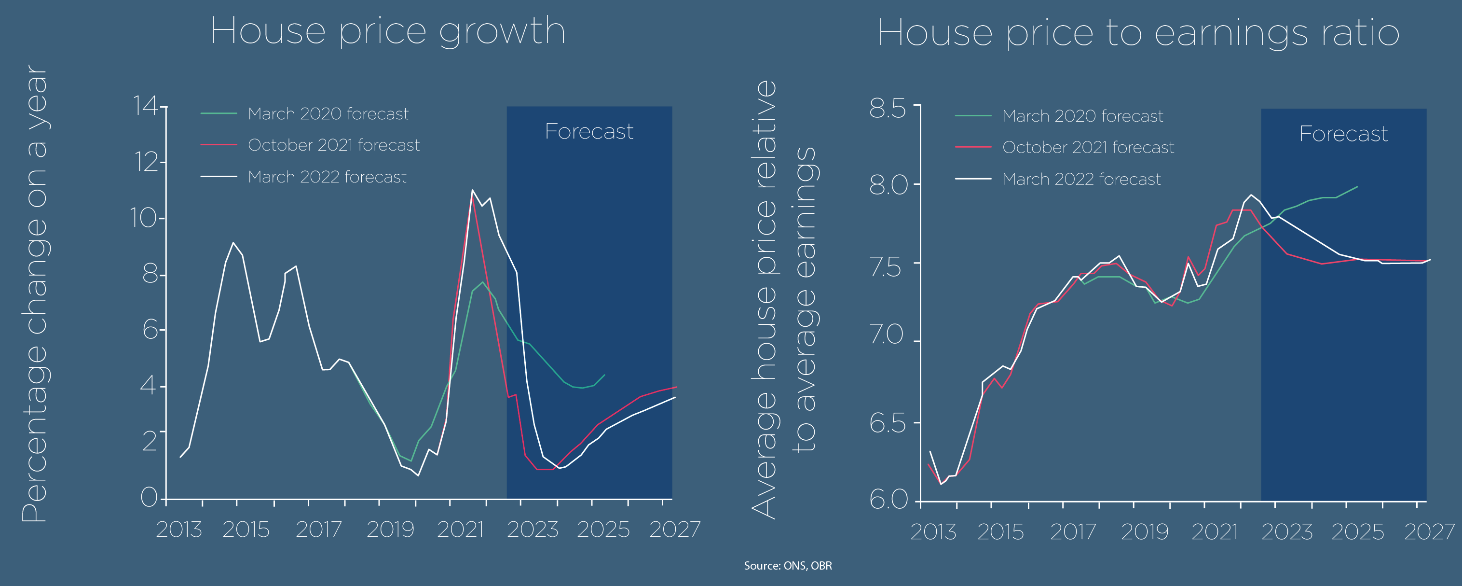

Halifax has reported that the average UK house price has increased by 1.4% this month (£3,860) which is the 9th consecutive month - the biggest jump since September. On average, the price of houses continues to be at +11% which is around its highest level since mid- 2007. The average house price is now £282,753 which is an addition of £28,113 compared to last year which is not far off the average UK earnings. In nominal terms, average house prices are 41.6% above the 2007 peak but in real (inflation adjusted) terms, this is 8.4% below the 2007 peak, according to the Nationwide House Price Index latest release covering the market to the end of March 2022.

The causation of this nominal price growth trend remains the same – limited supply and strong demand. Although this month Halifax has noted that they have seen more homes coming to the market, but nothing of any substantial impact to alter the trends we have seen so far. Russell Galley, Managing Director at Halifax summarised as “too many buyers are chasing too few properties.”

Reflecting on the two years since the pandemic, the housing market has proven far more resilient than was originally anticipated. Since March 2020, the average house price has risen by 18.2% over that period (£43,577) going from an average of £239,176 in March 2020 to £282,753 in March 2022.

The pandemic had shifted buyer demand placing a premium on those properties with greater space, both indoor and outdoor. Flats have increased by 10.6% or £15,404 over the last two years in comparison to the price of detached houses which has increased by 21.8% or £77,717.

Differing from last month’s report, the South West has overtaken Wales as the strongest performing region in the UK, hitting a new record of 14.6% annual growth rate. Wales is closely second with a rate of 14.1%. Alongside these new records, buyers are dealing with higher interest rates, which in combination with a higher cost of living is expected to slow down house price inflation over the next year.

In Chancellor Rishi Sunak’s Spring Statement, measures have been put in place to reduce a hike in National Insurance contributions as well as cuts to fuel duties. However, Zoopla has commented that these savings will be small and will do little to offset the rising cost of living. It has now been said that a large majority of those looking to get onto the property ladder will stay put in their existing homes due to the rising cost of mortgages which in turn will increase the demand for rental properties. In response to the Spring Statement and the economic headwinds, The Office for Budget Responsibility expects the annual rise in house prices will fall from 10% to 1% by 2023.

Russell Galley commented: “in the long-term, we know the performance of the housing market remains inextricably linked to the health of the wider economy. There is no doubt that households face a significant squeeze on real earnings, and the difficulty for policy-makers in needing to support the economy yet contain inflation is now even more acute because of the impact of the war in Ukraine.”

Looking at the wider economy, Silvia Rindone, EY UK&I Retail Lead has called this a period of a “new mindful consumer” with the latest EY ITEM Club Consumer Index reporting that consumerism is shifting as shoppers look to ‘buy less and do more’ - 40% of survey respondents say they are now spending more on experiences. From this, it has been reported that consumers are prioritising sustainability with ‘Planet First’ being the largest identified segment within the consumer index.

Secondly, affordability remains key to purchasing decisions as households are experiencing less disposable income. Consequently, in EY ITEM Club’s special Interim Forecast, the 2022 UK GDP growth forecast has been downgraded amid the diminishing consumer confidence due to rising commodity and energy costs. The latest predictions are now 4.2% down from 4.9% meaning that the forecasted GDP growth for 2023 is 1.9%.

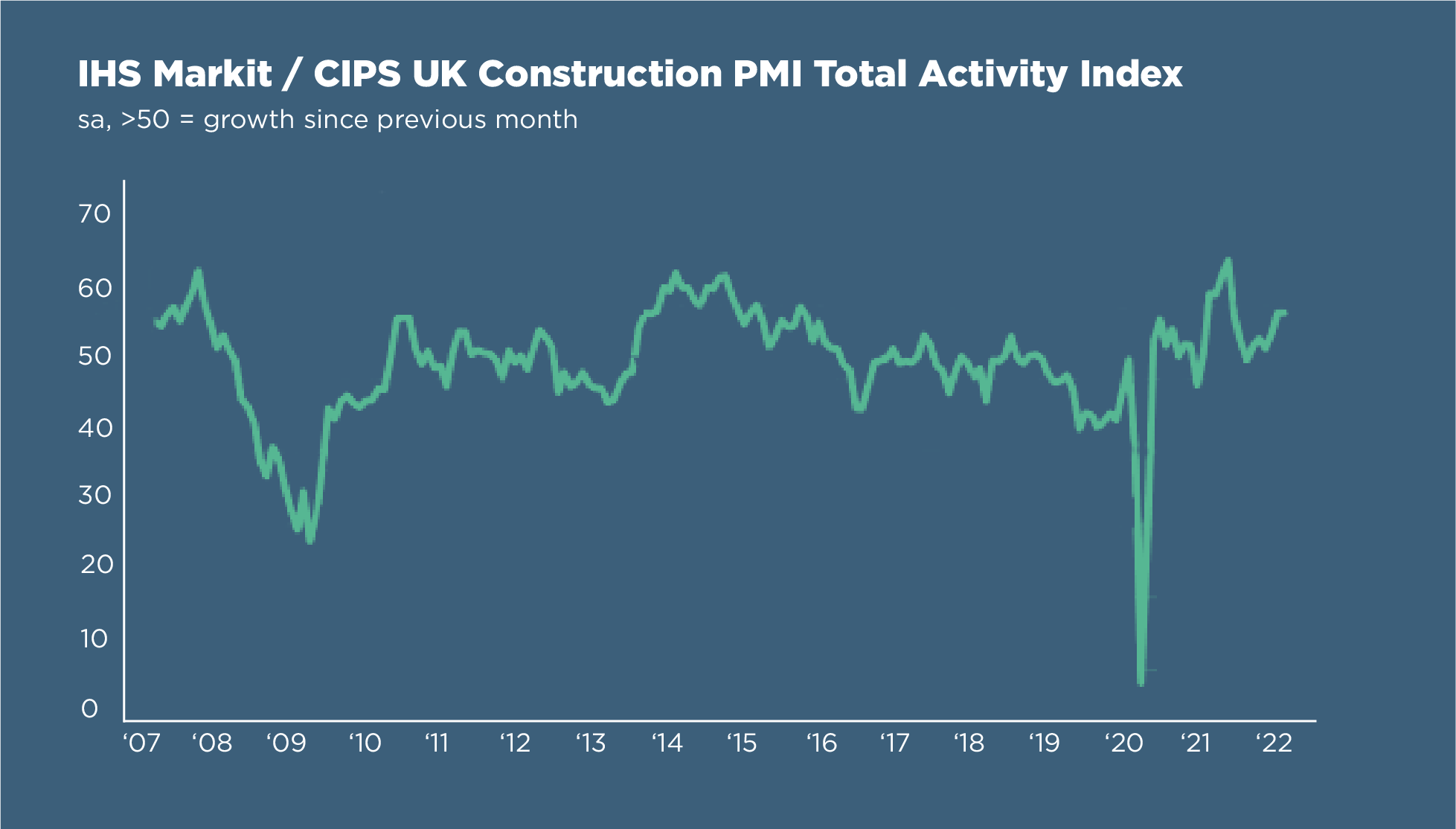

IHS Markit has noted that the construction output has continued to rise. However, business optimism has dropped to the weakest since October 2020 as a result of the concerns surrounding the war in Ukraine and inflationary pressures. Construction companies have said that there has been resilient customer demand despite the economic uncertainty. Yet again this month’s new orders outperformed the previous meaning output has increased every month since August 2021. The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index ® (PMI ®) registered 59.1 in March, unchanged from February and well above the 50.0 mark that separates expansion from contraction.

Reflecting this strong demand, input buying rose at the steepest pace since July in an effort to accumulate stock. This effort is also in response to capacity restraints, a lack of haulage availability and ongoing logistics difficulties. These obstacles, as well as the widespread issue of the cost of fuel, have created an acceleration in input prices. In addition, Duncan Brock, Group Director at the Chartered Institute of Procurement and Supply commented that: “Construction companies are braced for more disruption on the horizon as a result of the Ukraine conflict…With these severe challenges, it is no surprise that business optimism for the months ahead has been affected and fell to levels last seen in October 2020. The sector is facing several roadblocks.”

The economic and geopolitical uncertainty has meant that diminished optimism is widespread across many sectors. This is why in these times of economic pressure, property finance by property people makes so much sense – at CrowdProperty we work closely and productively with the developers we back, tackling market, site and situational challenges together in partnership. Having been developers ourselves, we are laser-focused on solving the pains of small and medium-sized developers - which is why we launched CP Capital last month, providing second-charge mezzanine finance for property developers. Property developer customers have consistently fed back to CrowdProperty that they would value mezzanine finance for their projects – to understand why, it helps to take a closer look at how development finance works.

The Capital Stack and why it is important

The capital stack refers to the tiers of beneficiaries behind an asset, in order of creditor hierarchy – it is the way in which developers structure the finance of projects, from funding the purchase of the asset through to associated development costs and exit. Fundamentally, there are two types of capital in development finance:

· Debt capital refers to funds invested directly into a project which are secured against the property asset. There is typically an interest rate associated with this capital that is paid to the lender and the debt (capital and interest) is paid back to the lender first, ahead of any profit.

· Equity capital “tops-up” the debt, effectively covering the costs of the rest of the project. It is the most risky element of the capital stack and can be costly for the developers as investors take a (sometimes very significant) share of profits.

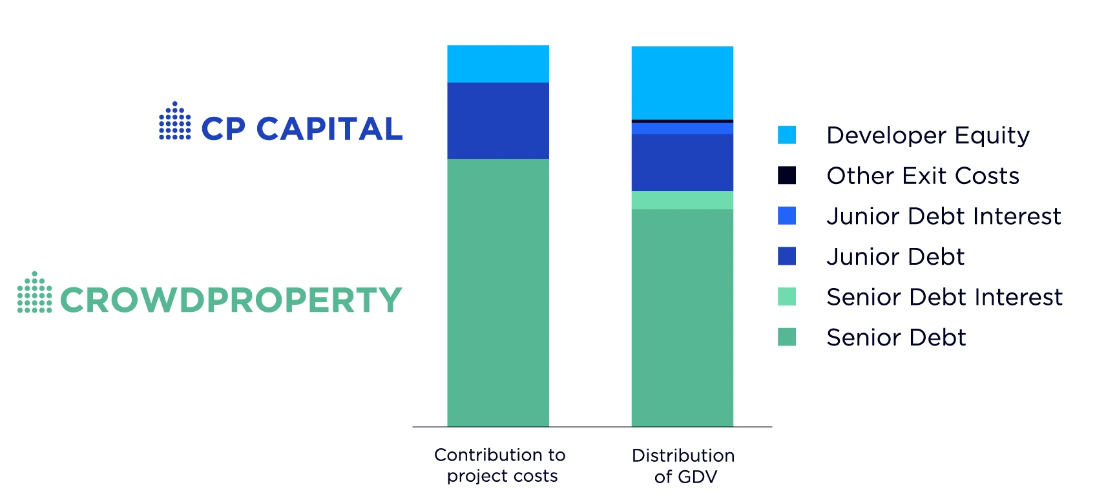

There are many sub-categories of finance within these two groups which can be used when structuring project capital, with consideration also being given to the distribution waterfall of capital. CrowdProperty has always provided senior, first-charge secured debt: this ensures that if the loan defaults, the business is able to take control of the asset and recovery processes, with CrowdProperty’s diverse sources of capital the first beneficiaries to be repaid. Mezzanine finance also falls under the debt tranche and is often secured by a second charge, meaning investors will only be paid after first-charge secured capital and interest (and any recovery costs in the case of default) is repaid. From a loan repayment perspective, this means that the senior, first-charge loan must be repaid before the junior, second-charge facility. Any funds remaining after these beneficiaries have been repaid will be returned in the form of profit to any equity capital investors and the developer themselves.

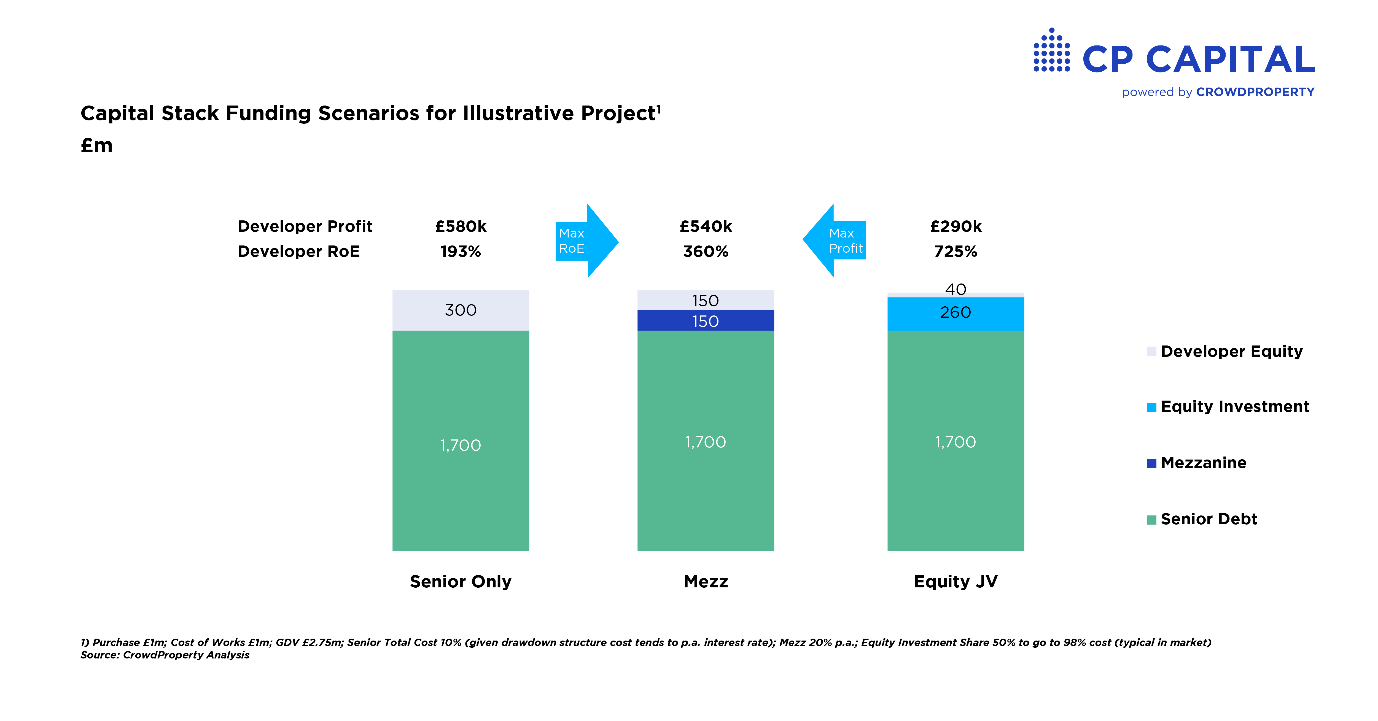

The balance of the differing types of capital within the capital stack can have a significant impact on the profit outcomes for the developer. For example, using a purposefully simplified example:

Consider a project where the developer is purchasing the asset for £1m, spending £1m on the build and on completion the property would be worth £2.75m. A CrowdProperty senior, first-charge loan could cover 70% of the purchase cost (£700,000) and 100% of the project costs (£1,000,000) meaning the developer would need to find £300,000 to cover the remaining project costs. Three possible scenarios for this project could be:

1) The developer puts in all the equity (£300,000) and sells for £2.75m, making £580,000 profit with a developers’ Return on Equity (ROE) of 193%.

2) The developer puts in £40,000 and an equity investor puts in £260,000 to make up the £300,000 of equity needed (total 98% of costs). HOWEVER this additional investor requires 50% profit share for bearing such risk. Now if the developer sells for £2.75m, the developer’s ROE is 725% but in cash terms they would only receive £290,000 profit for doing the same amount of work.

3) The developer puts in £150,000 with the remaining £150,000 coming from a mezzanine finance provider at an interest typical of second-charge secured capital. In this scenario, if the developer sells at £2.75m the ROE is 360% but the profit in cash terms is £540,000 – the developer keeps much more.

As the above example shows, introducing mezzanine finance should be a consideration for raising more capital for a project, whilst keeping as much of the total profit as possible. Whilst calculated developer ROE% is higher on the equity investor model, cash profit is much lower… and the alternative ROE (return of effort) is FAR lower for the developer. Never underestimate the value of your time/effort to deliver development projects.

Equity investment can be an extremely expensive route to financing your property projects – in fact, the marginal cost of capital of this equity JV model vs a mezzanine capital financed capital stack is 170.5% per annum… that’s the potential opportunity cost of not having your own sources of equity.

How can mezzanine finance be used?

Mezzanine finance is additional funding on top of senior debt finance, secured by a second charge. Mezzanine finance from CP Capital enables property professionals to complete any project funding requirements that are not met by the senior finance available. Senior debt typically accounts for 75% of costs; mezzanine finance can top this up to finance up to 95% of costs.

There are many applications of mezzanine finance, for example:

· To help with funds needed to purchase a property in order to move to development

· The global pandemic, supply chain challenges and input cost inflation could cause a project to overrun and eat into contingency - mezzanine finance could help to cover additional costs incurred as a result of these external factors

· On completion of a project, the built assets have added value but may take 6 months to sell – the developer could refinance the senior debt through a development exit and/or top up with mezzanine finance secured against the asset at the new value in order to gain funding to contribute towards the next project

How it works at CP Capital

CP Capital exists to serve developers’ additional funding needs, backed by the deep property expertise, disruptive fintech / proptech business model, absolute customer focus and reliability of our diverse sources of capital that we’ve proven over many years. Examples of projects where CP Capital has already supported developers’ projects include:

- Additional funds to assist with the continued development of a site comprising the restoration and conversion of existing barns plus three new build houses

- A second-charge offering to assist the developer with additional construction costs as a result of the pandemic, enabling the completion of a development comprising 10 residential apartments

- Additional funds provided towards the continued construction of 6 new build houses

All CP Capital mezzanine finance is coupled with senior development finance from CrowdProperty, ensuring that CP Capital security sits behind a rational, project delivery focused and proven senior lender with reliable sources of capital and a value-adding approach. It’s more efficient for developers managing one source of finance through the project capital stack too – the benefits of combining senior and junior finance from the same lender in terms of process, costs, communication and support, include:

· Single finance company for your capital stack

· Dedicated expert on hand throughout the project

· Single due diligence process

· Single set of professional fees

· Standardised intercreditor agreements

· Regulatory cover for junior tranche investment raising

As ‘property finance by property people’, CrowdProperty is dedicated to meeting the needs of the SME developer market in the UK and internationally, bringing back customer focus and changing the game of property project finance. This segment has been poorly served by traditional funding sources for decades, driving a two-thirds decline in their housebuilding output since 2008 in the UK alone. The crux of this decline, as highlighted in our research, was that 42% of developers saw funding as the biggest constraint to building more homes historically and 41% cited ‘better sources of finance’ as the highest potential enabler of more housebuilding going forward.

With demonstrated global ambitions and unprecedented technology investment in the sector, CrowdProperty is rapidly delivering innovative customer-centric solutions at pace and scale. We were first to market with our dedicated products for Modern Methods of Construction Finance, Planning Gain Finance and Development Joint Ventures Finance, in addition to launching in Australia in 2021.

Our in-house team of software engineers / data scientists have a continuous focus on data learning, analytics and machine learning on our processes to deliver excellent customer experience as well as bringing innovative technology solutions to our specialist development finance technology enablement. Our dedication to using technology to deliver a disruptive new era of property project finance as well as our determination to continuously revolutionise means that we’re in a uniquely strong position to go on to dominate the markets we currently play in and the many new markets we will be uniquely well placed to enter.

Whilst scaling across many dimensions, CrowdProperty is fundamentally dedicated to continuously innovating and improving our service offering aligned to customer needs. Our many ground-breaking products are now accompanied by a uniquely integrated mezzanine finance proposition in CP Capital – bringing senior and junior finance under one roof, with powerful benefits to developers, housebuilding and the UK economy. Together we build.

Find out more about mezzanine finance from CP Capital at www.cpcapital.com/developers

CrowdProperty is a leading specialist development finance lender, having funded £450m worth of property projects and agreed £250m of facilities. For development loans up to £10m, apply in just 5 minutes at www.crowdproperty.com/apply and our passionate property experts will share their insights and initial funding terms for your project within 24 hours.